Navigating the World of Cosmetics: A Guide to Harmonized System Codes

Related Articles: Navigating the World of Cosmetics: A Guide to Harmonized System Codes

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the World of Cosmetics: A Guide to Harmonized System Codes. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the World of Cosmetics: A Guide to Harmonized System Codes

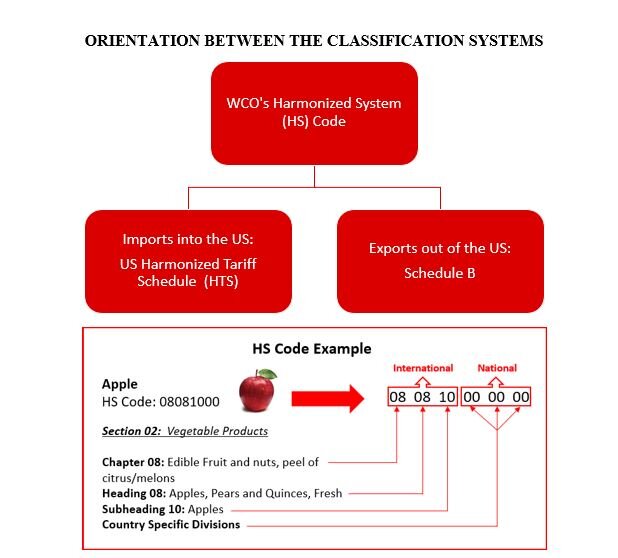

The global trade in cosmetics is vast and intricate, encompassing a wide array of products designed to enhance personal appearance and well-being. To ensure smooth and efficient trade, a standardized system of classification is crucial. This is where the Harmonized System (HS) code comes into play. The HS code is a six-digit numerical code used internationally to classify traded goods, providing a common language for customs officials, importers, and exporters. Understanding the HS code for cosmetic items is essential for businesses operating in this sector, as it influences import duties, taxes, and regulatory requirements.

Deciphering the HS Code for Cosmetics: A Comprehensive Breakdown

The HS code for cosmetics falls under Chapter 33 of the Harmonized System, which encompasses "Perfumery, cosmetics or toilet preparations." Within this chapter, specific codes are assigned based on the type of product, its ingredients, and its intended use.

Here’s a detailed breakdown of some key HS codes for cosmetic items:

3303.00: Perfumes and toilet waters

This code encompasses all types of perfumes, including eau de parfum, eau de toilette, and cologne, as well as toilet waters. The key defining characteristic of products under this code is their primary function: to provide a fragrance.

3304.00: Preparations for the care of the skin

This code covers a broad range of products designed for skin care, including:

- 3304.10: Preparations for the care of the skin, other than medicaments, containing as the main constituent soap

- 3304.90: Preparations for the care of the skin, other than medicaments, not containing as the main constituent soap

These codes distinguish between products containing soap as a primary ingredient and those that do not. Examples include moisturizers, cleansers, toners, face masks, and anti-aging creams.

3305.00: Preparations for the care of the hair

This code covers a wide range of hair care products, including:

- 3305.10: Preparations for the care of the hair, containing as the main constituent soap

- 3305.90: Preparations for the care of the hair, not containing as the main constituent soap

Similar to skin care preparations, this distinction is based on the presence or absence of soap as a primary ingredient. Examples include shampoos, conditioners, hair dyes, hair styling products, and hair treatments.

3306.00: Preparations for oral hygiene

This code encompasses products designed for oral hygiene, including:

- 3306.10: Dentifrices

- 3306.90: Other preparations for oral hygiene

This distinction separates toothpaste from other oral hygiene products such as mouthwashes, dental floss, and breath fresheners.

3307.00: Preparations for shaving or depilatory preparations

This code covers products used for shaving or hair removal, including shaving creams, foams, gels, and depilatory creams.

3307.10: Preparations for shaving

3307.90: Depilatory preparations

3308.00: Other cosmetic or toilet preparations

This code encompasses a wide range of cosmetic products not covered by the previous codes, including:

- 3308.10: Nail preparations

- 3308.90: Other cosmetic or toilet preparations

Nail preparations include nail polishes, nail treatments, and nail removers. Other cosmetic or toilet preparations encompass products like makeup, eye care products, and body care products.

The Importance of HS Codes in the Cosmetics Industry

Understanding the HS code for cosmetic items is crucial for several reasons:

- Accurate Tariff Classification: The HS code determines the applicable import duties and taxes. By correctly classifying products, businesses can ensure they are paying the correct tariffs and avoid potential penalties.

- Trade Compliance: The HS code is essential for complying with customs regulations and trade agreements. It helps ensure that goods are properly documented and cleared through customs efficiently.

- Market Research and Analysis: HS codes provide valuable insights into the global trade in cosmetics. By analyzing trade data based on HS codes, businesses can gain a better understanding of market trends, competitor activities, and product demand.

- Supply Chain Management: HS codes facilitate efficient supply chain management by standardizing product identification and classification. This helps businesses track inventory, manage logistics, and optimize operations.

FAQs by HS Code for Cosmetic Items

Q: What are the key differences between HS codes 3304.10 and 3304.90?

A: The primary distinction between these codes lies in the presence or absence of soap as a main constituent. 3304.10 covers skin care preparations containing soap, while 3304.90 encompasses those that do not. This difference can significantly impact tariff rates and regulatory requirements.

Q: What are the specific HS codes for makeup products?

A: Makeup products are typically classified under HS code 3308.90, which covers "other cosmetic or toilet preparations." However, specific types of makeup, such as lipstick, eyeshadow, or mascara, may be further categorized based on their specific ingredients and functionalities.

Q: How do HS codes for cosmetics differ based on the country of origin?

A: While the HS code system is standardized globally, individual countries may have their own specific tariff classifications and regulations for cosmetics. Therefore, businesses must research the specific requirements of their target markets to ensure compliance.

Tips by HS Code for Cosmetic Items

- Consult with a Customs Broker: For complex or specialized cosmetic products, seeking guidance from a customs broker can help ensure accurate classification and compliance.

- Stay Updated on HS Code Changes: The HS code system is periodically updated to reflect changes in trade patterns and product classifications. Businesses should stay informed about any revisions to ensure they are using the most current codes.

- Utilize Online Resources: Several online resources, such as the World Customs Organization (WCO) website, provide detailed information on HS codes and their application.

Conclusion

The HS code plays a critical role in the global trade of cosmetics, ensuring smooth customs clearance, accurate tariff classification, and efficient supply chain management. By understanding the specific HS codes for different cosmetic items, businesses can navigate the complexities of international trade and optimize their operations for success. Staying informed about HS code changes and utilizing available resources can help businesses navigate the ever-evolving landscape of the cosmetics industry and ensure compliance with international trade regulations.

Closure

Thus, we hope this article has provided valuable insights into Navigating the World of Cosmetics: A Guide to Harmonized System Codes. We appreciate your attention to our article. See you in our next article!